Sustained and increasing interest in study destinations challenging the Big 4

Earlier this year we launched our ninth round of our Navitas Agent Perception Survey (NAPS) to shine a spotlight on the voices of our valuable agent partners. Take a look at one of our key insights below.

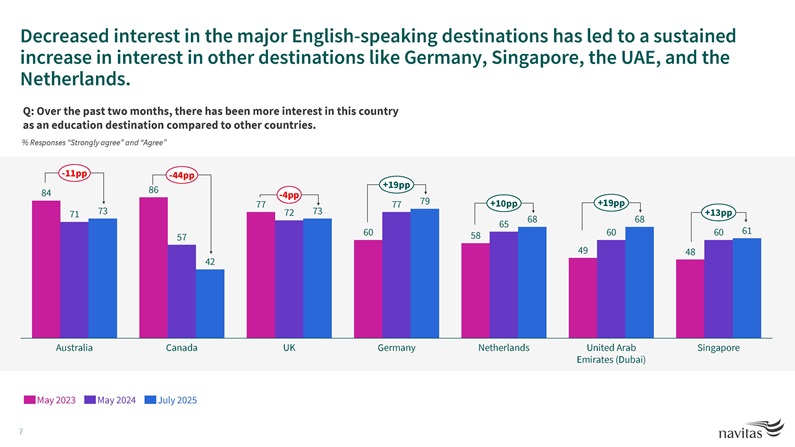

As we see traditional Big Four destinations attractiveness fall in light of greater government intervention and ongoing changes to policy, other international study destinations are experiencing significant and sustained gains.

Germany, Singapore, UAE, and the Netherlands all showed double-digit gains in attractiveness and interest in the 2024 Navitas Agent Perception Survey. These gains have been extended and sustained in the latest survey results in 2025.

Several factors are thought to be driving this shift. Cost competitiveness, (relatively) stable visa policies and perceived openness drive the appeal of these markets. In many cases, governments are taking a proactive and positive stance to increase their appeal and attractiveness to international students.

Sebastien von Gossler, Director of Recruitment Strategy – Germany, has said:

Germany has always been a highly-regarded place to study, particularly among EU students. In recent years, however, we have seen a significant groundswell in interest from students all around the world positioning Germany as a main international study destination.

Growing interest in other destinations comes with implications for the ‘Big Four’ destinations. To counter this new competition, Big Four destinations will need to highlight the value-adds on offer beyond cost – this includes global mobility, well-established employability links, and extensive research and alumni networks. Partnerships or TNE offerings in non-traditional destinations can also capitalise on this trend away from some Big Four destinations.

About NAPS

Since 2020, our global agent perceptions research has given the agent community a voice in the global conversation about international education. The findings have proven extremely valuable to us and our university partners, as well as government stakeholders and key media audiences.

We use the findings from each survey to advocate for strong and effective government policy in study destinations, and to support our university partners and agents across the world.

Where can you learn more?

Visit Navitas Insights for more detailed commentary and analysis, including a series of upcoming articles based on our latest round of research